What are the ways rate cuts can impact you as a homeowner?

South Africa’s housing market is expected to start showing signs of recovery after almost five years of subdued demand, thanks to the South African Reserve Bank’s recent decision to cut interest rates for the second time in as many months.

These rate cuts have been eagerly anticipated by the property market, with property practitioners, sellers and buyers all waiting for the positive impact on the supply and demand of residential properties.

If you’re thinking of becoming a homeowner for the first time, or considering the purchase of a larger home, here are the very real ways rate cuts can impact you.

Lower monthly instalments

In simple terms, the impact of rate cuts is felt in your pocket every month as a homeowner with a lower instalment. As a prospective homeowner, your affordability increases when rates reduce. Use

our bond repayment calculator to see how.

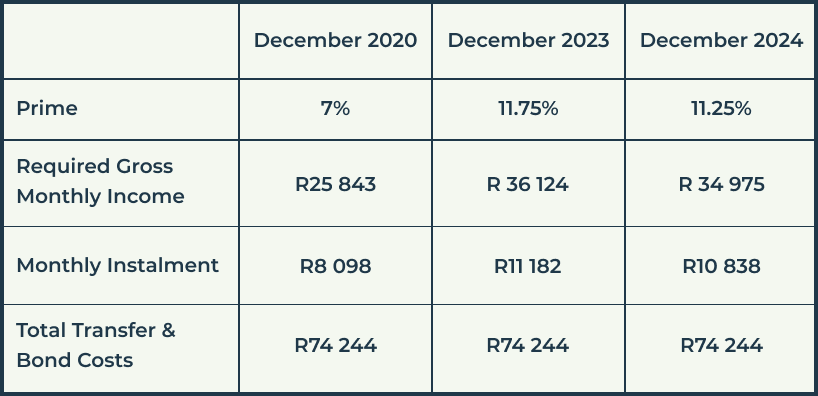

Paying off a home loan of R1m has looked something like this over the past five years:

Increased supply, demand and house prices

Existing homeowners have long felt the pain of high interest rates, as house price growth has been significantly subdued, and homes-as-investments haven’t appreciated as much as homeowners anticipated they would. This has also meant that the supply has been limited, with sellers holding onto their properties for longer.

Rate cuts impact the economy positively over time: with prospective homebuyers’ improved affordability, there is an increased demand for homes, hence pushing prices up. As a result, the subsequent increase in equity affords homeowners more financial options. Sellers too anticipate more interest in their properties and there are more options for buyers to consider.

Time to upsize or downsize?

Reducing rate cycles often drive the decision on whether it’s time for a larger home/better neighbourhood. If you’ve owned your home for several years, you have hopefully built up some equity that will be available to you if you sell and buy ‘up’. Conversely, if you’ve been considering downscaling, the same is true from an equity perspective. You can buy a cheaper home and invest the wealth you’ve created (in either a rental property or shares).

Start with a call to a property practitioner to value your existing property and compare this against what you still owe on it before starting the property hunt.

Pay off (all) debt faster

Rate cuts can provide an opportunity to pay off your most expensive debt faster. Consumers should consider consolidating debt into a single loan or targeting higher interest rate debt first, such as credit card or store accounts.

Making an effort to pay off short-term debt will improve your credit score, and banks look favourably on potential consumers who apply for a home loan by offering lower rates to those who have shown that they can manage their finances responsibly.