The South African Reserve Bank (SARB) holds one of the most critical responsibilities in the country’s economy: setting the repurchase (repo) rate. This key number influences the interest rate at which money is loaned to businesses and individuals, which in turn is a driver of economic growth by facilitating investment, consumption and job creation.

This rate affects and shapes spending patterns across all sectors, and for this reason, the SARB’s interest rate decisions are not made lightly. They are guided by a complex interplay of local and global economic indicators and reviewed six times every year based on the data and information available at each meeting.

Inflation: The Central Mandate

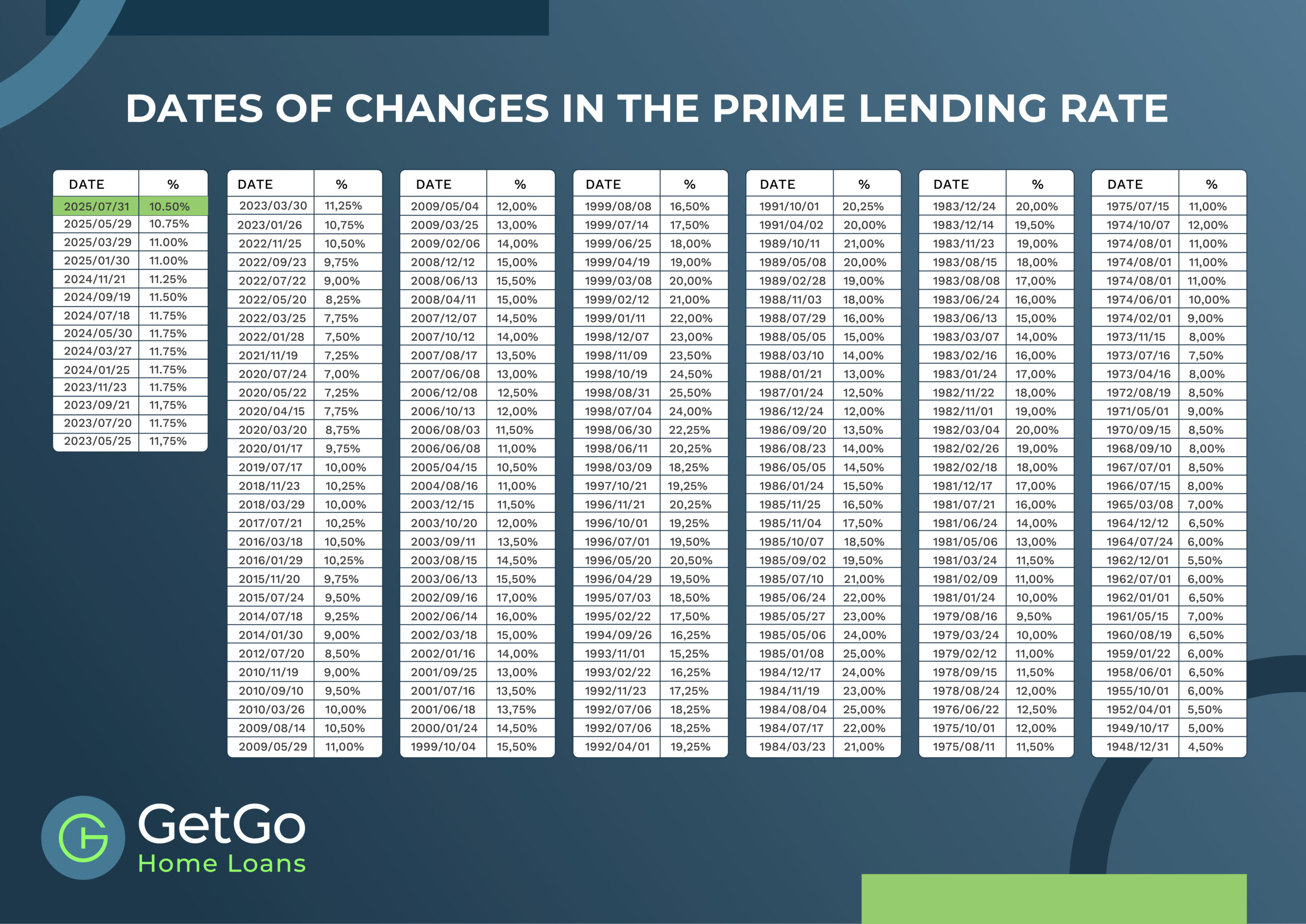

Current rate: 7.00% down from 7.25% (as at 31 July 2025). View past rate changes.

Inflation is the core of its monetary policy framework, and the monitoring of it is a primary concern for the SARB to determine its impact on the economy and consumers directly. The Reserve Bank targets inflation within a range of 3% to 6%, and adjusting interest rates facilitates this.

High inflation erodes the purchasing power of households, disproportionately affecting the poor and creating uncertainty in the economy. It’s not sustainable in the long term. When this happens, the SARB raises interest rates to slow consumer spending and thereafter lowers inflation until it’s back within range. Simply:

- Has inflation tracked too high for an extended period? Increase interest rates to stifle consumer spend which reduces credit applications as these become more expensive. This will reduce inflation.

- Is inflation sitting consistently beneath the target range? Lower rates to encourage consumer spend and credit-taking behaviour. With this increased demand, inflation will increase over time.

It effectively all comes down to inflation, as will become evident, and the impact this has on consumers and businesses is felt daily.

Economic Growth: It’s a Balancing Act

Current rate: GDP 0.1% (Q1 2025 vs Q4 2024)

While the SARB is not directly responsible for promoting economic growth, it must carefully weigh the trade-off between controlling inflation and supporting the economy. Interest rates, inflation and GDP have a complex, interconnected relationship. When GDP growth is low, raising interest rates can lengthen and eventually worsen the downturn by making credit more expensive for consumers and businesses alike, and forcing them all to spend less. The GDP growth rate and interest rates have an inverse relationship.

- Higher interest rates tend to slow down economic growth (borrowing becomes more expensive, and overall consumer spending decreases).

- Lower interest rates can stimulate economic growth (encourages borrowing and spending, thereby boosting economic activity and potentially increasing GDP).

Unemployment: A Persistent Concern

Current rate: 32.9% (16.8 million employed South Africans) (Q1 2025)

South Africa’s unemployment rate remains among the highest globally, at present exceeding 30%. Latest figures present a stark picture of South Africa’s persistent unemployment challenges, most dramatically illustrated by the youth unemployment rate climbing to an alarming 62.4% among those aged 15-24 years. Overall, the first quarter of the year saw a drop of 291,000 employed people to 16.8 million from 17.1 million in Q4 2024.

Joblessness is indirectly influenced by lower interest. Lower rates can support job creation by stimulating business investment, and increasing the likelihood of these businesses employing more staff to meet increased consumer demand.

Global Economic Conditions: Spillover Effects

A 30% tariff on South African goods and produce exported to the United States from 1 August 2025.

In today’s interconnected world, the SARB’s decisions cannot ignore global economic developments. A slowdown in major economies like China or across Europe, or tariffs levied on South African exports to the U.S. can reduce demand for South African products, impact commodity prices, and alter capital flows. Monitoring changes in interest rates is also critical. Higher interest rates in other countries may lead investors to pull money out of emerging markets, including South Africa, to chase better returns, putting pressure on the rand and forcing the SARB to respond.

Rand Strength and Currency Pressure

ZAR 19.74 / USD 1 (8 April 2025) // ZAR 18.29 / USD 1 (1 August 2025).

The strength or weakness of the rand is a vital consideration in the SARB’s decision-making process. A weaker rand makes imports more expensive, which can feed inflation – particularly in a country that relies heavily on imported oil, machinery and consumer goods. If the rand depreciates sharply due to domestic instability, global risk aversion, or a widening trade deficit, the SARB may raise rates to stem capital outflows and support the currency.

However, hiking rates to defend the rand can be painful, especially during times of low growth and high unemployment. This adds complexity to the SARB’s policy decisions, requiring careful timing and communication.

Conclusion: A Complex, Delicate Balance

The SARB’s interest rate decisions are the product of a sophisticated balancing act. While its primary goal is to maintain price stability, it must navigate a turbulent landscape shaped by weak growth, high unemployment, global uncertainty, fiscal pressures and currency volatility.

By responding cautiously to inflation signals while factoring in broader macroeconomic dynamics, the SARB aims to ensure a stable monetary environment that supports long-term economic sustainability.